After AMC and GME showed the world the kind of gains that can be made from a short squeeze, more and more investors are monitoring overly shorted stocks for potential breakouts. Here are a few volatile stocks under a dollar that are in position to squeeze the shorts and create profit opportunities for savvy investors.

All short data is according to OTCShortReport.com and NakedShortReport.com.

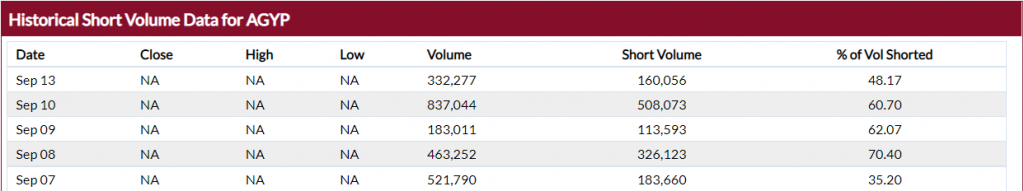

Allied Energy Corporation (OTCMKTS:AGYP)

AGYP saw a boatload of shorts come into their stock last week. Over 60% short volume each of the final three sessions to close the first full week of September. Yesterday, the shorts backed off a bit but there are still quite a few unclosed positions out there and this could be a prime squeeze candidate today.

AGYP, is an oil and gas exploration company that reworks existing wells. The company share price is up around 500% on the year which may be why some shorts were betting against the company, however the stock has been up as high as 1,540% which is why they may be treading lightly now. AGYP recently released a report from oil engineer Mark McBryde forecasting over $32 million in proven reserves between 2 of the company’s many oil & gas leases.

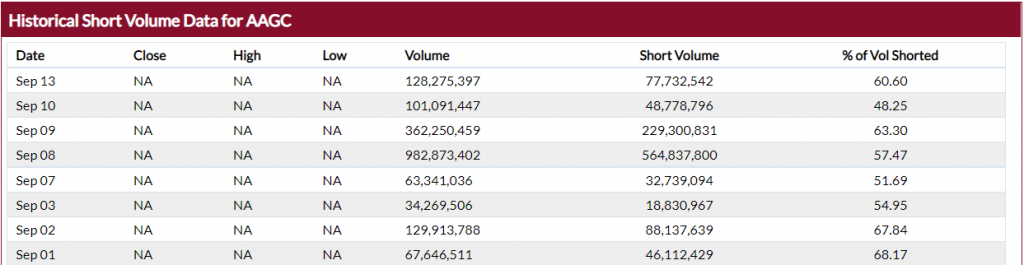

All American Gold Corp (OTCMKTS:AAGC)

Subpenny stock, AAGC, has experienced major short volume over the last 3 weeks. This is the kind of short volume that could be exposed with the right amount of buying pressure.

AAGC is in the process of recruiting a new CEO, this CEO may have a plan for the shorts.

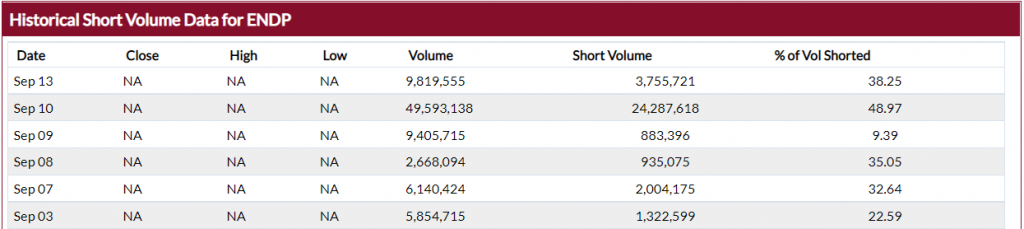

Endo International plc (NASDAQ:ENDP)

ENDP is seeing a ton of short interest, which might not be the best strategy by the shorts considering the company’s recent news.

ENDP has agreed to pay million to resolve lawsuits by New York state and two of its largest counties related to the sale and marketing of opioids. Endo said the settlement includes no admission of wrongdoing by Endo or its subsidiaries.

IVERIC bio Inc. (NASDAQ:ISEE)

Last week, 50% of ISEE’s trade volume was short sellers. Judging by yesterday’s trading, the squeeze may be on this week.

According to Benzinga, ISEE “shares surged 62.5% to close at $14.12 on Friday after Apellis Pharmaceuticals reported results from its Phase 3 DERBY and OAKS studies in geographic atrophy. IVERIC Bio, a competitor to Apellis, is also working on a product to treat geographic atrophy, called Zimura. Stifel initiated coverage on IVERIC bio with a Buy rating and announced a price target of $22.” This momentum continued Monday and could continue today.