Oil prices are currently rising at an incredible rate, and are unlikely to slow down according to several analysts. This week Bank of America noted in Bloomberg that Brent crude benchmark will hit $120 per barrel by the end of June 2022. This came after news that some industries have started to use oil instead of high-priced gas for their fuel needs. Most experts have not factored this into their pricing models, so at this point, going from around $85 a barrel to over $100 isn’t just an oil tycoon’s fantasy anymore.

The broken supply chain caused by the ripple effects of the pandemic is not only a major reason for these skyrocketing prices but could lead to the solution. According to the US Energy Information Administration In 2020, the United States consumed an average of about 18.19 million barrels of petroleum per day or a total of about 6.66 billion barrels of petroleum which was the lowest annual oil consumption in the US since 1995.

The United States imported about 7.86 million barrels per day (MMb/d) of petroleum from about 80 countries. Petroleum includes crude oil, hydrocarbon gas liquids, refined petroleum products such as gasoline and diesel fuel, and biofuels (including ethanol and biodiesel). With the supply chain making it harder to import products, we may turn to more domestic sources.

In the U.S., crude oil is produced in 32 states as well as along the shorelines. In 2020, about 71% of total U.S. crude oil production came from five states, where the oil and gas industry has been operating for generations. Texas is the largest domestic producer of oil in the United States. The Permian Basin in particular is forecasted to reach its pre-pandemic record high of 4.9 million barrels a day within the month and will continue climbing steadily in 2022, according to Rystad Energy.

Some Permian oil producers who may benefit from this increased need for domestic oil include (listed alphabetically):

- Allied Energy Corp. (OTCMKTS: AGYP)

- Apache Corp. (Nasdaq: APA)

- Callon Petroleum (NYSE: CPE)

- Centennial Resource Development (Nasdaq: CDEV)

- Chevron (NYSE: CVX)

- Devon Energy Corporation (NYSE: DVN)

- EOG Resources (NYSE: EOG)

- ExxonMobil (NYSE: XOM)

- Occidental Petroleum (NYSE: OXY)

- Ovintiv (NYSE: OVV)

- Pioneer Natural Resources (NYSE: PXD)

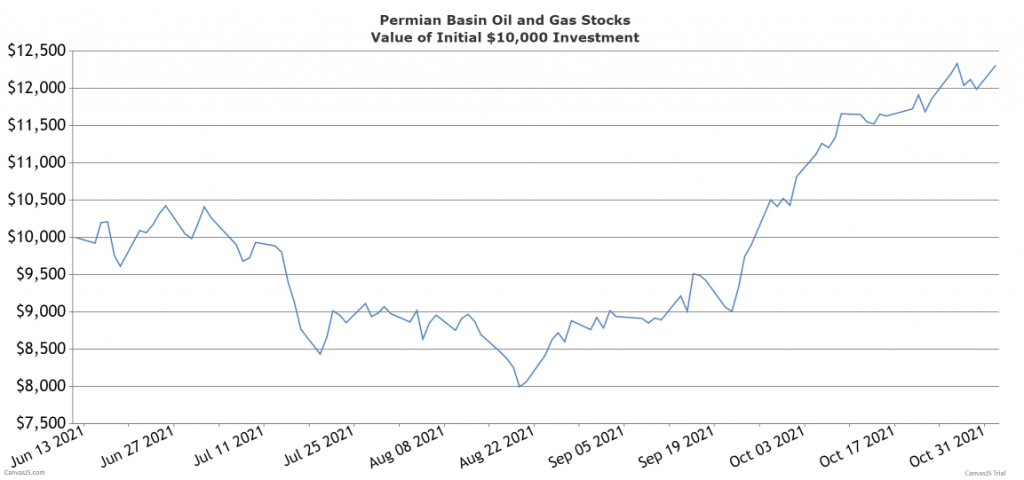

The chart below shows how stocks producing in the basin have already started to rally, and with the above-stated factors including oil potentially climbing over $100 a barrel and the need for more domestic oil production due to the broken supply chain, investing in companies with an interest in the Permian Basin could be wise.