A growing number of investors are aligning their money with their values regarding environmental sustainability, social responsibility, and corporate governance. Increasing the focus on ESG can provide companies with benefits such as a healthier corporate culture, a more positive and engaging public image, and a greater level of investment. The upward trend in analyzing ESG investment factors as part of the overall health and risk of an organization is one to which many corporations are responding positively. Even companies in industry that have long-standing reputations of pollution are stepping up to the challenge. Houston-based energy company Viking Energy Group (OTCMKTS: VKIN), for one, is focusing on ESG both in operations and mission

Firms like Viking Energy Group (OTCMKTS: VKIN) have even created their entire mission out of an ESG mindset. VKIN is an energy company focused on providing clean energy resources and solutions to their market. In fact, they are currently in a 25 year agreement with ESG Clean Energy, LLC regarding “patent rights and know-how related to stationary electric power generation”, including methods to utilize heat and capture carbon dioxide (the “ESG Clean Energy System”).

But what exactly does a focus on ESG look like and what kind of benefits can it create for a company?

What is ESG?

The triad of ESG criteria comprises environmental protection and conservation, social action and responsibility, and corporation governance. There are a number of factors investors consider when analyzing each of these three areas.

- Environmental: Investors will want to know how products are sustainably sourced and distributed. They will want to see a conscious effort to reduce things like water and air pollution, dependence on nonrenewable materials, and overall waste, much like VKIN’s biodiesel product, which is made from recycled vegetable oils, animal fats, or even recycle restaurant grease. Many investors may also want to see how a firm is going beyond just reducing waste, but is actively trying to replenish resources and repair ecosystems and environments where they conduct business. Viking Energy (OTCMKTS: VKIN) is also leading the way here by marketing a carbon capturing system that allows them to sell carbon emission commodities.

- Social: The social aspect of ESG can focus on a number of factors around relationships to employees, customers, and communities. This means having a strong company culture or one that allows greater work-life balance and progressive compensation. Investors may also look for how a company interacts and engages with customers and what level of service is provided to its customers. Perhaps the most recently publicized and debated factor is that of the role of a given company in its community. What does the company stand for and what does it stand against? How does a company respond to certain events and changes within a community? A company’s response to each of these will speak to its understanding of and commitment to its target audience.

- Governance: Governance may be the least discussed but does impact the business just as much as social and environmental factors. Governance is all about leadership, internal controls and auditing, as well as pay structures, oversight, and how the company is complying with its overall mission and values. Topics in this area include executive pay, how complaints and accusations are handled, and how the company is led from the highest levels. Ultimately, it is how the company is being managed and what guidance and oversight is being given to that management.

Benefits of ESG

A study released in McKinsley Quarterly in November of 2019 indicated growth in five key areas for those firms who exercised ESG consciousness and practices.

1. Top-line growth

2. Reducing costs

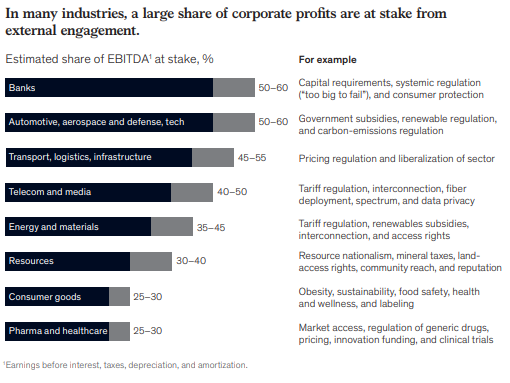

3. Minimizing regulatory and legal interventions

4. Increasing employee productivity

5. Optimizing investment and capital expenditures

VKIN ESG Investment Finding Success

Large companies often receive the most publicity for their commitment to ESG, but smaller firms, like Viking Energy Group (OTCMKTS: VKIN) may be a more sound investment, as the benefits their share prices reap from adopted ESG strategies could be that much more concentrated because of their smaller market cap.

VKIN’s acquisition of a green biodiesel plant (a renewable energy source and alternative to nonrenewable energy sources) both illustrates their commitment to a sustainable energy future and places them in a positive position as biodiesel demand and prices rise Recently, they have also entered into an agreement with their majority-owned subsidiary Simson-Maxwell to manufacture and sell their Ozone System, a medical and bio-hazard waste treatment center.

For those investors looking for small firms who benefit from strong ESG practices, Viking Energy Group (OTCMKTS: VKIN) could be a great addition to the watchlist.