After the company came up with a key announcement yesterday, it was in significant focus among investors, and it remains to be seen if the Liberty Star Uranium & Metals Corp. (OTC: LBSR) stock makes any move over the coming days or not.

Significant Announcement

The company reported the assay results from its 100% owned Red Rock Canyon Gold Project (RRC) located at the Mountain Project in the Southeastern zone in Arizona. However, more importantly, Liberty Star Uranium & Metals noted in yesterday’s news release that the project could possess commercially significant metals related to porphyry copper-gold-molybdenum geologic structures. As it happens, those structures are spread across the stretch from the central zone of Arizona to the northern part of Mexico.

Strong Numbers

Additionally, the channel sampling that took place at the Red Canyon gold property routinely produced spectacular grades. In the latest assay results, the grades reported stood at 107.5 gpt and 60 gpt. It was also revealed that not too long ago, Liberty Star Uranium & Metals had also received the results from as many as 95 rock channel samples spread across the gold-bearing zones of the property. It may be a good time to add the stock to your watchlists.

Key Quote

Liberty Star Chief Geologist, Jim Bryce, stated, “We submitted these samples in early November, so the six-week wait has ended with an early Christmas present for us. These exciting results prove to us that mineralization on the RRC project is much wider spread than we, or previous prospectors, originally thought. Our crew still has more sampling to do, so our hopes are high that we will see continued success in the channeling this spring. When the two high-grade samples from this report are plotted on a map along with other previous samples in the area that returned >10 gpt Au, there are six distinct hits in five different channel samples that form a gently sigmoidal line trending just west of due north.”

Traders Notes

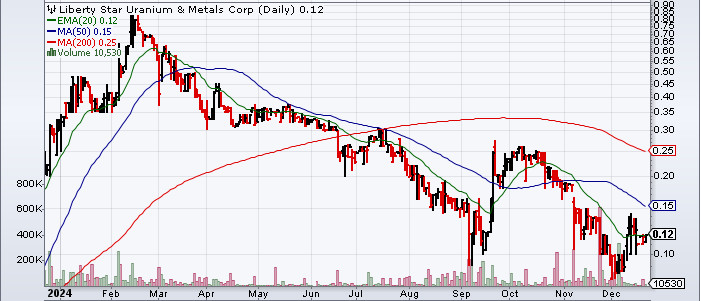

| +/- EMA(20) | 0.12 (+0.00%) |

| +/- SMA(50) | 0.15 (-20.00%) |

| +/- SMA(200) | 0.25 (-52.00%) |

| 5-Day Perf. | – |

| 1-Month Perf. | -13.36% |

| 3-Month Perf. | -51.26% |

| 6-Month Perf. | -51.52% |

| YTD Perf. | -61.29% |

| 1-Year Perf. | -42.86% |

| RSI(14) | 48.17 |

| ATR(14) | 0.02 |

| ADX(14) | 41.42 |

| Beta (5Y) | 0.29 |