Brownie’s Marine Group Inc. (OTCMKTS:BWMG) is moving in a range after releasing its Q4 and full-year results for the period ended December 31, 2021. In the fourth quarter, the company reported a 115.6 % increase in total revenue to $2 million, compared to $930,000 in Q4 2020.

Trading Data

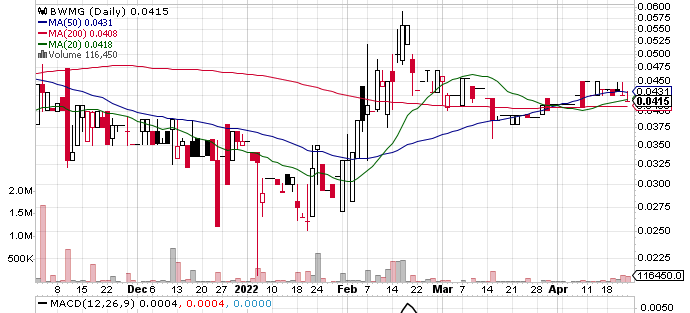

On Friday, BWMG stock fell 2.35% to $0.0415 with more than 116K shares, compared to its average volume of 63K shares. The stock moved within a range of $0.0415 – 0.0432 after opening trade at $0.0415.

Key Details

BLU3, Inc.’s revenue climbed 294 % to $1.04 million in Q4-2021, compared to $263 200 thousand the previous year. For FY2021, total revenue was up 56.4% to $6.24 million versus $3.98 million a year before. The company’s Third Lung revenue was up 6.4% t6o $2.9 million, while LW Americas revenue jumped 25.8% to $616,000 in FY 2021. Blu3 In revenue soared 191.2% 6o $2.2 million from $769,700 in FY2020.

CEO Chris Constable said they are delighted with FY2021 results, and the more than 56% growth in sales shows that Brownie’s Marine Group is experiencing considerable momentum in its markets. However, he said growth was hampered by global supply chain and logistic disruptions, resulting in high costs for freights and components. So, in the coming weeks, investors should watch BWMG.

Key Quote

Chris Constable, CEO of Brownie’s Marine Group, Inc. stated, “We were pleased with our fiscal year 2021 results. We believe that the sales growth of greater than 56% means that our Company is experiencing significant momentum in our markets. This growth was hampered a bit by the worldwide supply chain and logistics challenges leading to higher costs for components and freight, negatively impacting our aggregate margins year over year. Additionally, we invested significantly in human capital to ensure that next year’s sales can continue at a similar pace. While both items affected our profitability for 2021, the Company has adjusted pricing to counter the increased component cost and I also believe that our front-loaded investment in people will pay dividends in the coming year.”

Technical Data

BWMG stock is trading below the 20-Day and 50-Day Moving averages of $0.0422 and $0.0432 respectively. Moreover, the stock is trading below the 200-Day moving average of $0.0408.