Although the company’s Chief Executive Officer William Petty made a major announcement yesterday, investors did not take kindly to it and the Franklin Mining (OTCMKTS:FMNJ) stock suffered from a significant selloff. Petty announced yesterday that Franklin Mining had been waiting for more than 12 months for the complete approval on its Form 1-A filing with the United States Securities and Exchange Commission.

Trading Data

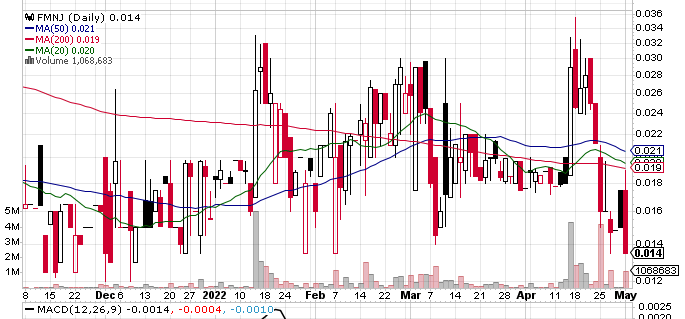

On Monday, FMNJ stock fell 10% to $0.0135 with more than 1.06 million shares, compared to its average volume of 579K shares. The stock moved within a range of $0.0135 – 0.0190 after opening trade at $0.0175.

Key Details

More importantly, when the full approval is actually granted, it would allow Franklin Mining to raise as much as $10 million in the form of fresh funding. As it happens, the first sum of money had been remitted to Franklin Mining so that it could start work on the development phase in its lithium mining work in Catamarca in Argentina.

At this point in time, the demand for lithium is rising rapidly and the decision from the company to raise funds for the purpose of funding lithium projects could prove to be a long term boost. Petty noted that the final approval from the SEC was a welcome boost for Franklin Mining. In addition to that, the company had also put together a highly credible team of lithium experts and geologists to take the project forward.

Key Quote

“Now that we have full approval by the SEC, as well as a solid team of geologists and lithium specialists, we are excited to begin planning for phase one of development,” announced Mr. Petty. “We are also pleased to welcome Richard Song as Vice President of Marketing in Asia. Mr. Song will be working to market our product to lithium buyers in Asia.”

Technical Data

FMNJ stock is trading below the 20-Day and 50-Day Moving averages of $0.0187 and $0.0205 respectively. Moreover, the stock is trading below the 200-Day moving average of $0.0192.