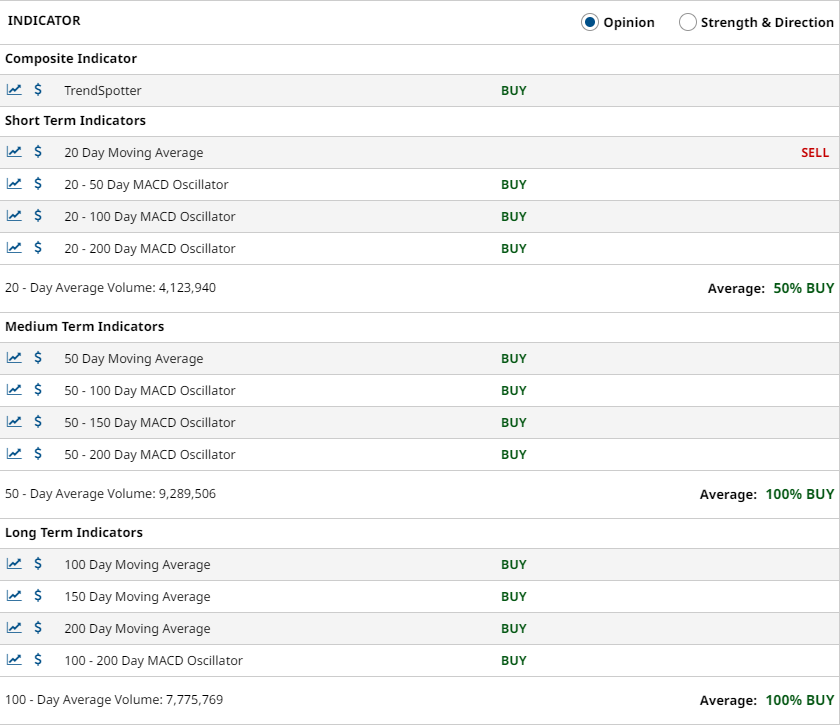

- Barchart.com has rated Wearable Health Solutions, Inc. (OTCMKTS: WHSI) as a 88% Strong Buy.

- Investors scanning for breakout stocks last night probably found WHSI on their scans, and the stock could see an influx of new buying.

- Momentum could push this stock through the $0.03 resistance.

WHSI is signaling bullish on several moving averages:

50 day

100 day

150 day

200 day

All point to higher highs for the medical device company.

WHSI’s 20-50 Day, 20-100, 20-150, 50-100, 50-150, 50-200 and 100-200 MACD Oscillators all signal ‘buy.’

FUNDAMENTAL CATALYST

Wearable Health Solutions (OTCMKTS: WHSI) filed an 8K with the SEC recently. The filing contained multiple catalysts that could positively influence WHSI’s share valuation in the near and long term.

- Uplisting News- the company is now in the process of and is now preparing its application to uplist. When a company uplists from the pink sheets it provides investors the peace of mind that comes with increased regulation, transparency and disclosure. This can translate to:

- Lower Cost of Capital–that can in turn accelerate the company’s growth and increase margins.

- Analyst Coverage– uplisting allows analysts to cover the stock and this is important because analyst coverage can lead to:

- Institutional Investment

- High-Net-Worth Individual Investors

- Increased Liquidity and Valuation- all of the above factors can lead to increased interest in the stock on all levels, and this influx of interest can be a force multiplier.

- Newly Updated Websites- The newly updated sites bring more to the table than might meet the eye at first glance. In addition to looking professional and more polished than previous iterations; investors, buyers, and dealers will find them much more informationally robust. Investors familiar with WHSI may be able to infer the next logical conclusion…the iHelp Max 4G launch.

The launch would be another catalyst for share valuation.

For the fiscal year ending June 30th, 2021, WHSI reported some 8,000 end users plus an order book of about 2,000+ potential activations, which earned the company record revenues ($1.3 million) in 2021.

Launching this new device could lead to a consecutive year of record sales. Start your research on WHSI today.

This article is part of a sponsored investor education program.