This morning most investors are going to be on the lookout to track those companies that had been in the news cycle yesterday, and hence, it would not be a surprise if the Entrex Carbon Market Inc. (OTC: RGLG) stock gets into focus today. The company was in focus yesterday after it made an announcement with regards to certain agreements.

Agreements Executed

The company hit the news cycles on Tuesday after it made an announcement with regards to the fact that it had executed the agreements pertaining to the acquisition of as many as 15 Level 3 EV (electric vehicle) mobile charging facilities. The facilities would serve airport rental car companies in Florida and a range of Californian port authorities. In the news release, Entrex Carbon Market announced that it was a singular opportunity to provide Level 3 mobile charging facilities to car rental outfits that often don’t get access to grid power.

Further Information

It was also noted that the company anticipated that it would also be able to make charging module utilization more efficient and boost the revenues of the facilities in question. Entrex Carbon Market expected EBITDA growth to the tune of $17 million on a yearly basis.

CEO Comment

“This is a unique opportunity to provide Level 3 mobile charging solutions to national rental car companies that lack access to grid power,â said Stephen H. Watkins, CEO of Entrex Carbon Market, Inc. It’s a critical challenge to be mandated to maintain an EV fleet without the necessary charging infrastructure. This results in underutilized or completely idle assets. This moment mirrors the 1920s, when gas stations and convenience stores emerged to support gasoline-powered vehicles while simultaneously enabling us to expand revenues and EBITDA through these acquisitions.â (www.EntrexPowerProduction.co)

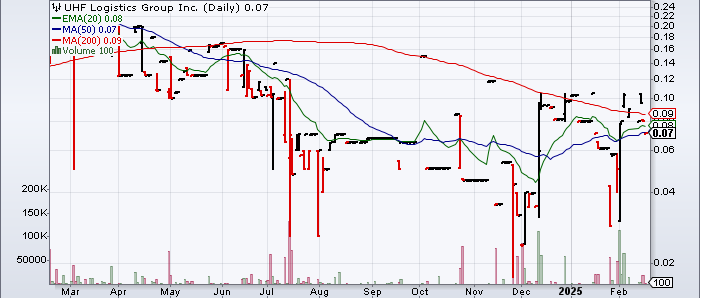

Technicals

| +/- EMA(20) | 0.0759 (-6.98%) |

| +/- SMA(50) | 0.0719 (-1.81%) |

| +/- SMA(200) | 0.0852 (-17.14%) |

| 5-Day Perf. | -21.56% |

| 1-Month Perf. | -0.56% |

| 3-Month Perf. | +31.96% |

| 6-Month Perf. | +8.62% |

| YTD Perf. | -26.84% |

| 1-Year Perf. | -62.84% |

| RSI(14) | 48.44 |

| ATR(14) | 0.01 |

| ADX(14) | 13.86 |