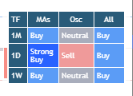

Marketing Worldwide Corp. (OTCMKTS: MWWC) has several major indicators pointing in the right direction. Looking at the chart below you can see a fantastic setup forming. Read on to learn why several potential catalysts could push this stock even higher.

Moving Averages MWWC technical chart is signaling ‘buy’ on:

- 50 Day

- 150 Day

- 200 Day

MACD Oscillators on the MWWC chart are pointing bullish:

- 20-50 Day

- 20-200 Day

- 50-150 Day

- 50-200 Day

- 100-200 Day

Seeking Alpha’s Composite Technical Indicator is calling this a buy, particularly for a longer-term outlook. Looking at the potential MWWC catalysts on the horizon, that’s not a bad idea.

Catalysts That Could Send MWWC ‘To Da Moon’

Share Buyback or Forward Split The company has announced one or the other is on its near-term forecast. Either announcement would be a huge buy signal.

$MNS token official release. DOGE, SHIB, and many other altcoins have shown just how much money they can generate. MWWC’s proprietary token is close to a full release and could be a major revenue generator.

Earnings Updates MWWC has already noted several impressive potential 2022 earnings based on beta testing of its Minosis Platform. These numbers could increase significantly and haven’t factored in $MNS profits and several other verticals MWWC is working on. Any revised updates could be a major catalyst for MWWC stock.

BTC Bottom – Bitcoin prices are coming off of their lows, with projections putting the price 50-100% higher in the coming months, these numbers will increase in turn.

Buffett Backs Bitcoin

Stocks like MWWC will benefit from increased faith in the cryptocurrency industry. Long-time critic and top investor, Warren Buffett, just divested from Visa and Mastercard; and invested $1 billion in fintech bank, Brazil’s Nubank. News like this only adds to the potential for a major Bitcoin rally.

Make sure MWWC is on top of your watchlist.

This article is part of a sponsored investor education program.