Tego Cyber Inc (OTCMKTS:TGCB) is one of the companies that had been set up for the purpose of exploiting the considerable opportunity in the cyber threat intelligence space.

Trading Data

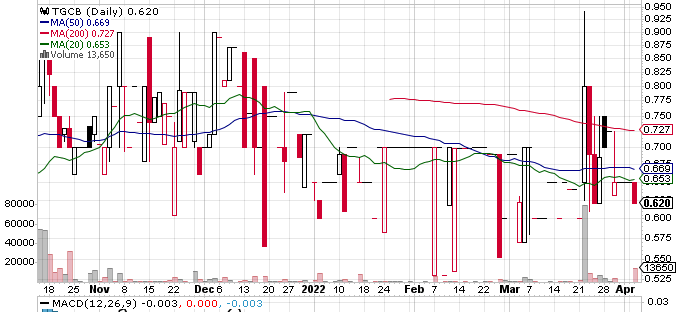

On Tuesday, TGCB stock fell 4.62% to $0.62 with more than 13.6K shares, compared to its average Tuesday of 2.5K shares. The stock moved within a range of $0.3000 – 1.2500 after opening trade at $0.65.

Tego Cyber Inc. Discusses 2022 Revenue Potential and Strategic Growth Plans with The Stock Day Podcast

Yesterday, the company was in focus after Shannon Wilkinson, its Chief Executive Officer, went on The Stock Day Podcast for an interview with the host Everett Jolly. Interview with such podcasts can often prove to be a boost for any company but it did not seem to be the case for Tego Cyber as the stock suffered from a selloff yesterday and ended the day with a decline of as much as 5%.

However, it might still be a good idea to perhaps take a look into what Wilkinson spoke about during the interview. While talking about the latest milestones that had been achieved by Tego Cyber, the CEO noted that sales were going to be generated soon.

To that end, the company had already hired the services of Brent Watkins in January 2022 for the purpose of leading the business development efforts. Wilkinson went on to state that Tego Cyber was going to make announcements in the coming months with regards to the clients that it gets onboard.

Key Quote

Jolly began the interview by commenting on the Company’s latest achievements, and asked about their sales progress. “Sales are imminent,” shared Wilkinson. “We brought on Brent Watkins in the beginning of January to lead our business development, and reach out to some of his contacts from the time he was with the FBI,” she explained. “We hope to have some news in the coming month about some clients coming onboard, as well as our partnership with Vation Ventures.”

Technical Data

TGCB stock is trading below the 20-Day and 50-Day Moving averages of $0.66 and $0.67 respectively. Moreover, the stock is trading below the 200-Day moving average of $0.73.