It is rare you find a producing oil company on the OTC markets, let alone one priced under $1. This is why we are profiling Allied Energy Corporation (OTCMKTS:AGYP). As you’ll learn below:

- AGYP has just started producing oil at their Green Lease

- AGYP has several other potential producing projects on the horizon

- AGYP has the makings of a potentially enormous short squeeze

First, let’s look at why a domestic oil and gas producer is so valuable to investors in the current market climate.

Oil Prices Reach Record Highs

As of press time, Brent and WTI crude oil are both well over $80 a barrel. Brent crude has broken its highest spot price since October 2018 while the US benchmark WTI hit its highest price since late 2014.

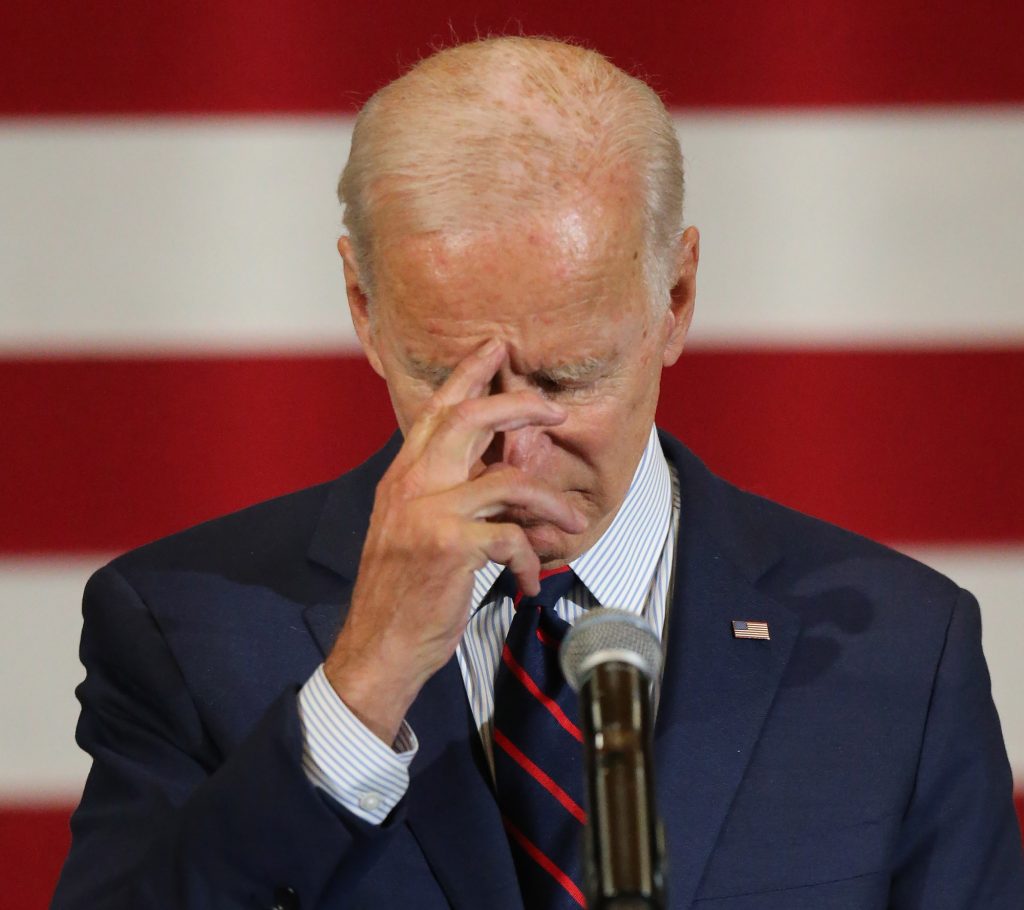

The world is back open for business as the Coronavirus pandemic wanes. This has caused a spike in demand, while supply continues to lag. Despite President Biden calling for OPEC and its allies to increase production, his actions would seem to point to more supply issues in the future:

- A commitment to cut greenhouse gas emissions in half by 2023

- Shutting down the Keystone Pipeline

- Putting a moratorium on NEW oil and gas drilling leases

AGYP an Oil & Gas Play Even Biden Can’t Stop

Allied Energy Corporation (OTCMKTS: AGYP) focuses on reworking proven oil and gas projects. This means their projects won’t be considered “new” leases and therefore aren’t subject to this administration’s exploration moratorium. While these are old leases, as you’ll see from the company’s geological studies there are still massive potential reserves in several of the company’s leases.

AGYP is an upstream oil & gas exploration company with several projects, one producing, one close to production, and has just made news with another high potential acquisition. The company’s leases are primarily in Texas, on the historically lucrative Permian Basin.

AGYP’s strategy is to identify proven oil & gas leases that for whatever reason have been abandoned. This strategy takes a lot of the ‘guesswork’ out of exploration that is generally one of the most costly functions of a traditional exploration company. The company instead focuses on assessing the number of potential reserves and the best way to extract those resources.

This is a streamlined approach that differentiates AGYP from its competition and should benefit its bottom line.

AGYP’s Projects

The Green Lease

The Green lease is AGYP’s producing lease, they just announced this major milestone earlier this fall. The Green lease is situated on the Bend Arch between the Midland Basin, to the west, and the Dallas-Fort Worth Basin, to the east. The area has a long history of oil and gas operations due to world class hydrocarbon sourcing from the Barnett shale and multiple stacked reservoirs in the Canyon Group, Strawn Group, Caddo Formation, Palo Pinto Formation, Marble Falls Group and Mississippi Limestone. These reservoirs can be accessed through both vertical and horizontal drilling and respond well to modern completion techniques.

In a recent geological study, the Green lease was found to have Proven, Possible and Probable reserves as follows:

Proved: $2,026,500

Probable: $5,781,300

Possible: $12,755,300

TOTAL: $20,563,100

One major note to make about these numbers is they are factored at a price of $45 per barrel. That’s just over half of the current WTI spot price, so you can almost double these numbers to get an accurate assessment of how big an opportunity the Green lease is.

This lease alone makes AGYP worth strong investment consideration, but there’s more:

The Annie Gilmer Lease

The Annie Gilmer lease could be AGYP’s next producer. The lease is located in the small community of Crystal Falls, Texas on the banks of the Clear Fork of the Brazos river, approximately thirty miles north of the town of Breckenridge, Texas. There are a total of five wells drilled on the lease, that is approximately 300 acres. There are five wells on the lease that were drilled to the Mississippi formation that is encountered at approximately 4100’ below the surface of the earth. The Mississippi formation, when caught on good geologic structure can produce prolific oil and gas cumulative numbers. There were six wells drilled on the lease starting in the mid 70’s with the last being drilled in 1989. Since the initial well, the lease has produced over five hundred thousand (5000,000) barrels of high gravity oil and over five hundred million (500,000,000) cubic feet of very rich natural gas. There are two permitted saltwater injection well on the lease. One of the wells will be re-converted to an active oil and gas producer.

In the same geological study referenced above, the Annie Gilmer lease was found to have Proven, Possible and Probable reserves as follows:

Proved: $6,704,900

Probable: $1,902,200

Possible: $3,587,700

TOTAL: $12,194,800

Again, like we stated above, these numbers are factored at an extremely low price per barrel ($45). Given AGYP’s streamlined approach to exploration, and the current direction of oil prices these reserves will be even more valuable than the above numbers suggest.

That’s only two leases worth a conservative estimate of just over $30 million.

AGYP’s twitter shows video and photos of progress being made at this lease, meaning we could see production news in the near future.

*NEW* The Prometheus Lease

On October 6th, AGYP announced the acquisition of the 325 acre Prometheus Lease located in Garza County, Texas. AGYP’s interest is the 28 Unit Well 1H, which was producing approximately 200 barrels of oil per day and 300,000 cubic feet of natural gas per day as recently as 2016. There are multiple wells included in the Prometheus Lease, one of which is currently producing about 60 barrels per day. But of utmost initial importance for Allied is bringing the Prometheus 1H Well back online. When this well was originally tested and submitted to the Texas railroad commission by Apache Corporation in 2014 their report showed 335 barrels production per day along with 298,000 cubic feet of natural gas per day with 2557 barrels of flow back and formation water. Allied will utilize 2021 technology combined with their experienced crew to bring these numbers to fruition.

Natural Gas prices are also near record highs which is an added bonus to this lease.

The well was spudded to begin drilling in November, 2013, and was completed in April of 2014. The well was drilled horizontally to a total measured depth of 11,370’ with a vertical depth of 7,792’. The well was drilled to test the Mississippian formation that has been a very prolific formation in nearby vertical wells. The well was drilled with great observation and completed and treated with the best industry practices in all phases of drilling and completion. The well completion phase consisted of an amazing 24 stage fracturing program to fully expose the Mississippian formation for potential production. An assortment of logs were run to determine areas to determine the best locations along the lateral for potential oil and gas production. It should be noted that several other oil and production zones encountered in the vertical section of the well indicated commercial oil and gas potentials according to well logs and analysis, providing even more behind pipe reserves.

Other AGYP Projects Include:

Byers Heirs #2 Deu Pree Field, Wood County

A well originally completed in the Woodbine formation from perforations of 5736’ – 80’ making 74 bbls per day of 16 deg gravity “heavy” oil and accumulating 78,000 bbls of oil. When abandoned in 1997 the well was capable of making 60 bbls of oil per day but at the time there was no market for heavy oil and the price per bbl was discounted considerably due to the low gravity. Today there is a large demand for this type of crude oil and it can receive a significant bonus over the posted price of West Texas Intermediate. The produced oil will be blended with condensate to raise the gravity of the product and lower the gravity of the condensate. This will alleviate any pricing discounts applied due to lower gravity of the oil and the higher gravity of the condensate.

The well has been successfully re-entered and is waiting on final completion, which will entail the drilling of 4 or 5 short lateral legs (horizontal) information to enhance the daily production rates.

There is another productive zone above the Woodbine that has produced in the field, the Sub-Clarksville, that can be completed for commercial production.

Byers #1, Deu Pree Field, Wood County

A well that is an offset to the #2 well and was completed in the Woodbine formation. It had an initial rate of 122 bbls of oil per day and accumulated 120,000 barrels of oil. It was abandoned in 1997 when a leak in the casing occurred and attempts to patch the leak failed. Today technology has improved dramatically and repairing a casing leak such as this one is much more successful. A re-entry of this well will be proposed to re-establish commercial production in the Woodbine and/or from a completion in the Sub-Clarksville. If the repairing of the casing leak is not successful a liner can be cemented inside the existing casing to repair the leak.

Cameron #1, Deu Pree Field, Wood County

A well that was drilled south of the two Byers wells. The well was completed in the SubClarksville formation as it was not drilled to a depth sufficient to evaluate the Woodbine formation. The initial rate was 91 bbls of oil per day and accumulated 30,000 bbls of oil. It was abandoned when the price of oil fell below $10 per bbl. Consideration should be given to deepening this well to the Woodbine for evaluation and possible completion.

Continental State Bank #14, East Texas Field, Gregg County

Located in the East Texas Field this is a shut-in, fully equipped well capable of commercial production of oil from the Woodbine formation. Wells surrounding this well are currently producing commercial oil. The pump jack should be replaced with a submersible pump to allow for a greater daily fluid rate. In this field the amount of oil produced daily depends mainly on how much fluid is produced. Costs for the disposal of produced water is minimal as a connection to the East Texas Saltwater Disposal System is on the lease.

The Austin Chalk formation sits on top of the Woodbine and the well is located in an advantageous position geologically to afford the opportunity to produce commercial oil from that zone, which can be commingled with the Woodbine.

Thrash “A” #1 & #2, East Texas Field, Rusk County

2 wells equipped for production with the exception of a pump jack missing from the #2 well. A submersible pump should be placed in the well to increase the daily fluid rate. If successful in increasing the oil produced the pump jack on the #1 well should be replaced with a submersible pump.

The Austin Chalk is present in the wells but the quality of the rock is such that a completion in that zone is not recommended at this time.

Julia M. Finney Lease, East Texas Field, Rusk County

There are 8 shut-in wells on this lease completed in the Woodbine formation, of which 6 wells are fully equipped for production. The wells should be reworked and placed back into production. There are wells on all sides of the lease that are currently producing. Also, the lease is in a position whereby the Austin Chalk should be commercially productive. We are planning to eventually re-complete 3 or 4 of the wells in the Austin Chalk and 2 to 3 wells will be reconditioned to produce from the Woodbine using submersible pumps.

The Austin Chalk is present in the wells but the quality of the rock is such that a completion in that zone is not recommended at this time.

Dora Hastings #1-R & #2, Glen Hummel, SW Field, Wilson County

2 wells located in south Texas that are completed in the Poth B Sand and equipped for production. In this area the Poth A, B, C and D sands are productive in various wells. The Poth A sand produces from a waterflood operation on adjacent leases to the east. The Poth C sand produces immediately to the north. The A, B and C sands are present in the offset wells to the east and in 2 wells that were completed in the Austin Chalk immediately to the west, and each are expected to be productive in our 2 wells. If warranted additional development may occur on the lease with new drilling or a re-entry on one of the Austin Chalk wells.

F. M. Ezzell #2, Palmer (Poth B) Field, Wilson County

A well fully equipped for production with the exception of not having stock tanks and oil/water separation. There are other Poth sands that are productive in wells in the immediate area of this well and are expected to be present in this well. A cased hole log should be run in the well to evaluate other productive zones for re-completion. Also, the well should be reworked to re-establish commercial production from the B sand.

Moody & West Lease, Loma Novia & Government Wells S. Fields, Duval County

This is a prospect to drill a well to 2,800’ and complete in 1 of the 5 productive sands that are present in the Loma Novia and the Government Wells formations. The lease has produced previously but each productive well was not produced from each productive sand. The wells were abandoned due to the condition of the well equipment but were still productive. Also, there are 7 to 10 drilling sites for future development.

That’s 12 leases for one small company that might not remain so small if they continue on their current trajectory.

AGYP’s Commitment to Transparency

One reason investors should be pleasantly surprised about this opportunity is the company’s commitment to shareholder transparency. AGYP doesn’t just do the bare minimum of filings and press releases; they take it a step further and let you behind the scenes with their extremely active Twitter account; here’s a few examples of AGYP giving investors the full picture:

This leads me to potentially the biggest reason AGYP is a real gem investors should start researching immediately.

AGYP’s Short Squeeze Potential

If you followed AMC or GME last year, you know just how profitable a good short squeeze can be. Those squeezes came with companies that actually were underperforming and probably deserved to have such a large short interest. This is not the case with AGYP, as we’ve described so far, this company has much more going for it than your average penny stock, their Green lease alone can make this company much more valuable than its current share price.

The shorts, however, don’t see it that way, they see a stock that was trading as high as 83 cents earlier this year down, and are trying to pounce. 6 of the past 22 trading days (as of Oct. 13, 2021) the short interest has been over 50% of the volume. These short-sellers could be in a position to get burned.

Keep in mind, most of these shorts are brokers monitoring thousands of stocks daily, how do we know they’re brokers? Because brokers are the only segment of the market that can freely short (and sometimes ‘naked’ short) OTC stocks in these numbers.

For them, it is purely a numbers game, and they only see a sub $1 stock that their algorithms have called for a short position on.

They are not following this story and that is where you as an investor hold the upper hand.

Look at all the potential catalytic announcements that could send AGYP’s shares above $1 in the near future:

- Production numbers from the Green Lease

- Initial Production from the Annie Gilmer Lease

- Positive Progress at the Prometeus Lease

- News from any of the other Leases AGYP is working

- Another Major Acquisition

AGYP has shown this past year that when investors get behind it, it can really move. This has been building a large following for the company of long and short-term investors who have profited and/ or are in a position to profit. This means that as more news comes in there will be even more momentum to the bullish side.

All it will take is enough continued momentum to push the shorts’ hands and it will be a force multiplier that I for one am excited to see.

Conclusion

So to review:

- AGYP is a domestic oil and gas exploration company

- Their ‘rework’ strategy protects them from Biden’s anti-exploration policies

- They have 12 leases

- 1 producing

- 1 near production

- 1 major acquisition

- A recent geological study found over $30 in proved, possible, and probable reserves at 2 of their leases; these numbers are based on $45 barrels of oil, the current spot price is well over $80 meaning this could be worth much more

- AGYP, unlike many OTC companies, is committed to shareholder transparency

- AGYP has attracted a massive short position, that could be squeezed out in the near future and that squeeze could bring the stock to new highs

Make sure you put AGYP on your watchlist today.

Due Diligence Links:

Website: alliedengycorp.com

Twitter: twitter.com/alliedenergyco1

Recent News: https://www.otcmarkets.com/stock/AGYP/news